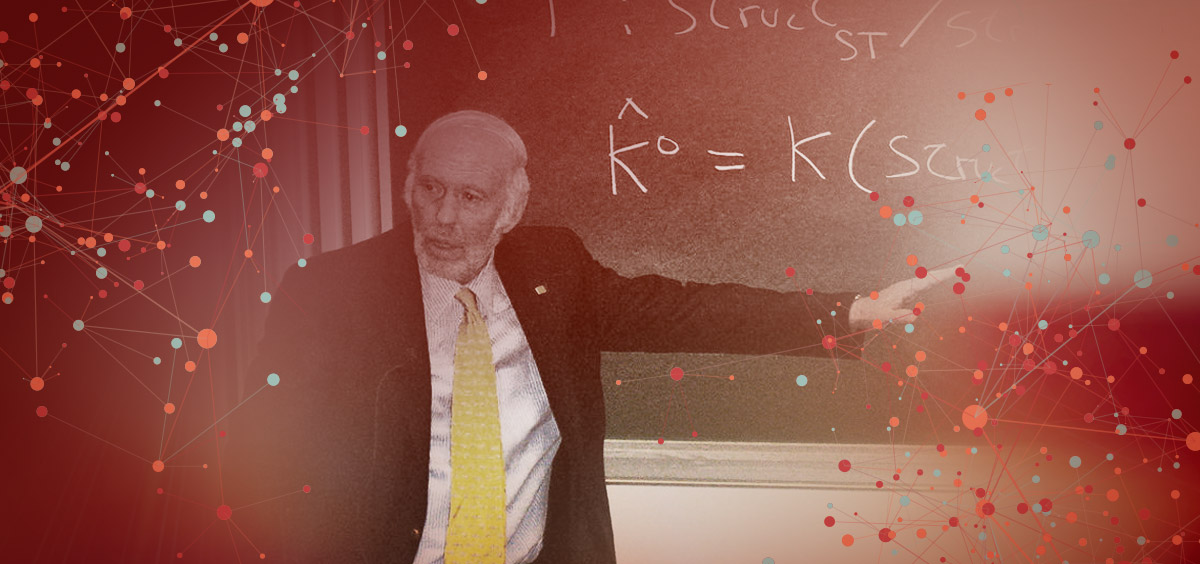

Take a look at the New York Time Business Best Seller list and you’ll find that The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution is currently number one. This book describes the (now seemingly) inevitable rise of the application of mathematical and statistical methods to financial and risk management problems. While B2B Marketing Research has always used stats and mathematical models to improve decision making, it wasn’t until relatively recently that this concept was introduced to the financial world, to massive success.

The book is a compelling read, part biography, part historical reference, it walks the reader through high level, lightning fast trading algorithms used to command incredible financial returns. A few passages are worth highlighting for market researchers however as they relay an important component of decision making amongst people while under financial duress. These passages are of particular interest because, when implemented correctly, they can be very powerful to maintain revenue momentum in B2B markets during recessions, or during times of financial difficulty.

“Humans are most predictable in times of high stress—they act instinctively and panic. Our entire premise was that human actors will react the way humans did in the past . . . we learned to take advantage.”

This critical passage highlights the way many people will make errors in their decision-making during times of stress. People will panic, they will make assumptions about their customers, they will act on their “lizard brain” and not analytically. But this isn’t all, our ability to even listen to feedback from surveys is also dampened. The Association for Psychological Science points out “neuroimaging data indicate that stress may influence neural responses to feedback: Responses to positive and negative feedback in the brain were greatly reduced under stress as compared to when there was no stress, suggesting that stress may dampen your perception of the subjective value of a decision.” That is, not only are you more likely to make a poor decision during stress, you are also less likely to even listen to your customers during times of high stress.

Thus NY Times Number One Business Bestseller is a story about how you can create incredible wealth by simply choosing to not listen to your instinct during times of stress. Entire careers, entire businesses, indeed entire fortunes have been built off of people guessing (correctly) that you, as a business person, will stop listening to feedback when sales decline and a recession occurs. Our mantra is the exact opposite, you must invest in market research and survey based feedback exactly when you think you do not.

1 Zuckerman, Gregory. The Man Who Solved the Market (p. 153). Penguin Publishing Group. Kindle Edition.